For example if your roof is 25 000 new and is 15 years old on the date of a claim and the insurance company attributes a rate depreciation of 1000 per year on the roof then they will subtract the depreciation from the value of the new roof and only pay you the.

Roof depreciation rate.

If you didn t deduct enough or deducted too much in any year see depreciation under decreases to basis in pub.

Some items may devalue more rapidly due to consumer preferences or technological advancements.

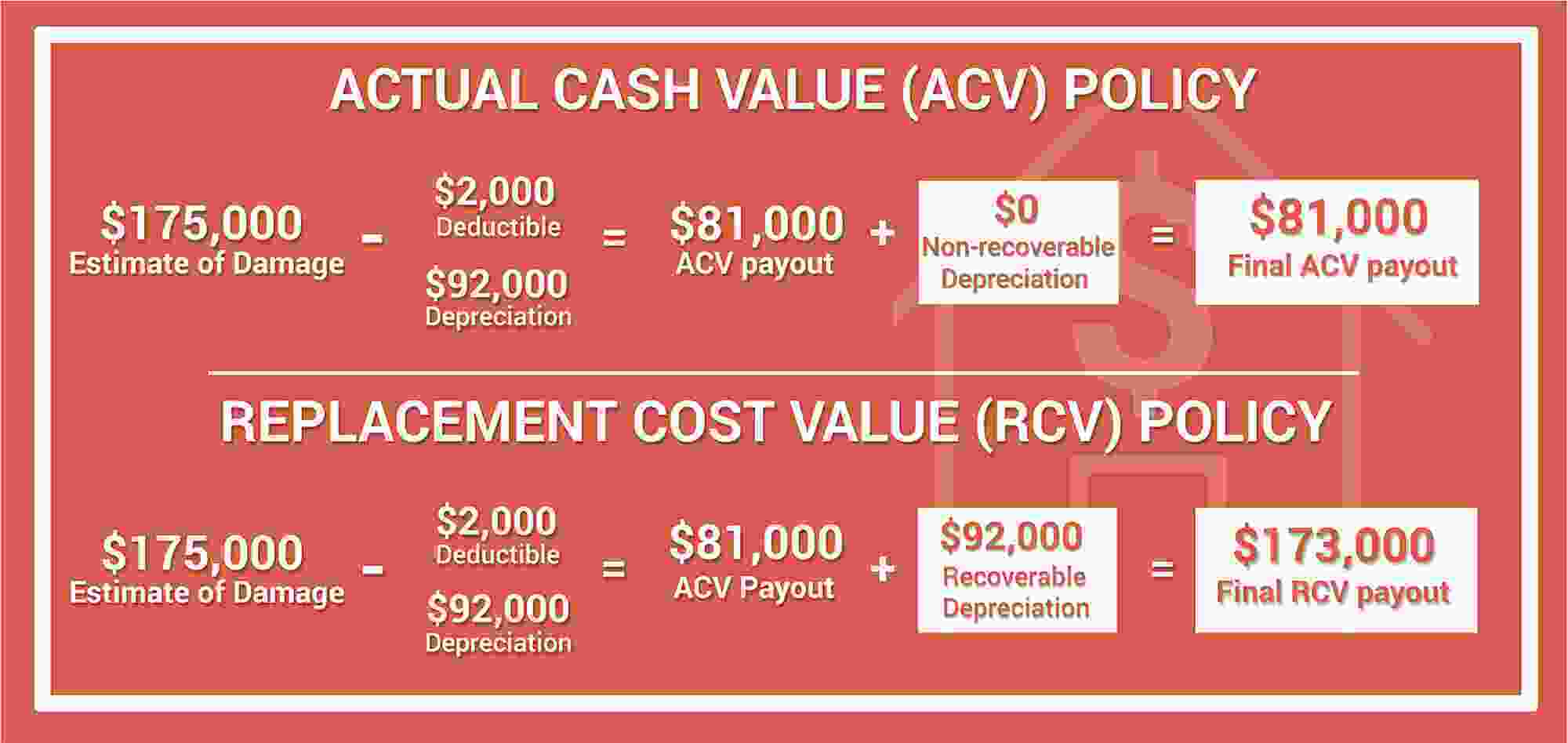

As you can see in the above example doe will receive 14 000 from his insurance company whereas smith will receive only 4 000.

Depreciation you deducted or could have deducted on your tax returns under the method of depreciation you chose.

Calculating depreciation begins with two factors.

The depreciation guide document should be used as a general guide only.

For example if you ve owned a rental property for 10 years before you installed a new roof you can depreciate the roof over 27 5 years even though you have 17 years of depreciation left on the property.

The irs states that a new roof will depreciate over the course of 27 5 years for residential buildings and over the course of 39 years for commercial buildings.

Is generally depreciated over a recovery period of 27 5 years using the straight line method of depreciation and a mid month convention as residential rental property.

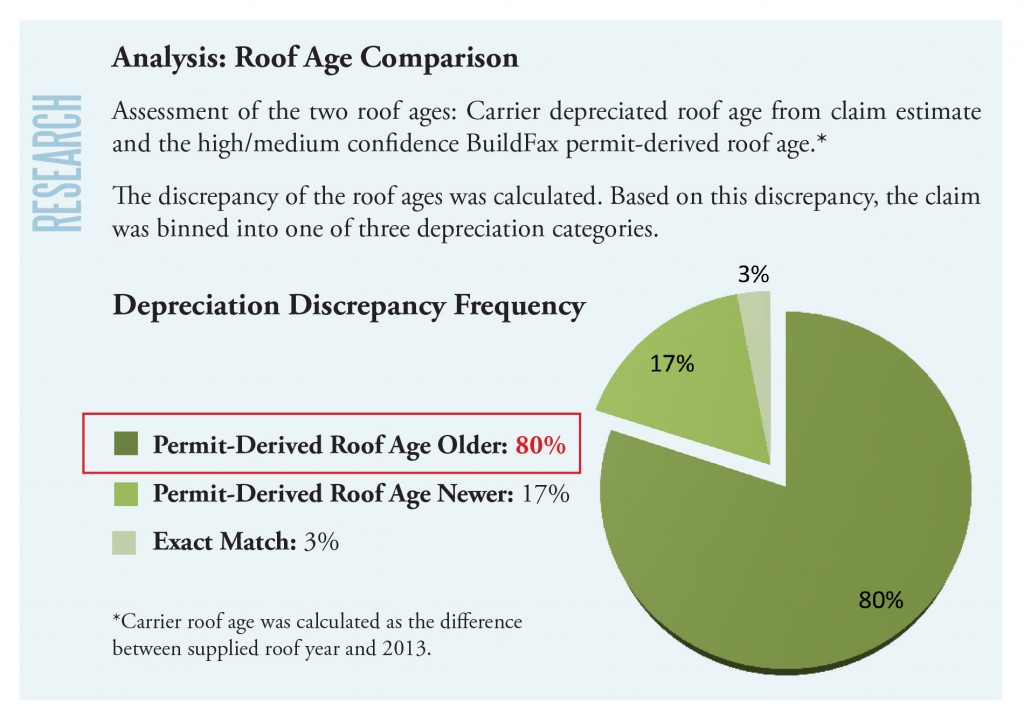

The older the roof the more deducted for depreciation.

Actual cash value will give you the depreciated value at the time of the loss on your roof.

We replaced the roof with all new materials replaced all the gutters replaced all the windows and doors replaced the furnace and painted the property s exteriors.

This means the roof depreciates 545 46 every year.

Take your annual depreciation deduction and prorate it for the number of months the roof was in service during the first tax year this is the figure you enter in line 18.

The replacement cost of the roof and the expected lifetime of the roof for example the average cost to replace a roof is 10 000 and asphalt roofs generally have a lifespan of 15 years.

Insurance valuation methods can be confusing and difficult to determine based on your individual needs and circumstances.

The difference is depreciation.

The irs uses the straight line method to calculate the depreciation of your roof which means that the depreciation of your roof is calculated evenly across a set period of time.

Special depreciation allowance or a section 179 deduction claimed on qualified property.

Individual taxpayers report income and expenses for rental properties on schedule e of form 1040.

There are many variables which can affect an item s life expectancy that should be taken into consideration when determining actual cash value.

You must also file form 4562 in the year you first place the roof in service.